The Beneficial Owner Information Report is a new requirement by the Financial Crimes Enforcement Network – also known as FinCEN.

The Beneficial Owner Information Report, better known as the BOI, requires all eligible businesses to state both their own information, as well as the information of anyone who owns more than 25% of a company.

It was started at the beginning of 2024 due to the Corporate Transparency Act and is intended to stop financial crimes of all sorts, such as money laundering and terrorist funding.

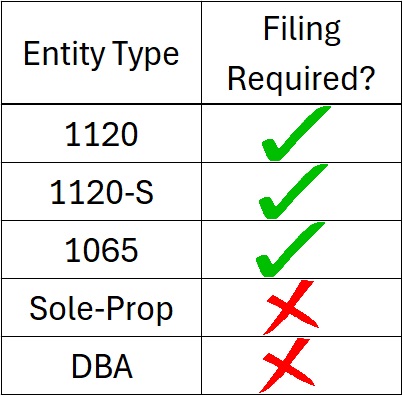

Currently any corporation, partnership, LLC, or sub-corporation is required to file. Sole proprietorships are not currently being asked to file, nor are DBA’s.

The deadline for filing changes depending on when the business was started. For any business created before December 31, 2023, the owners have until December 31, 2024 to file. Any business created between January 1 and December 31, 2024 has 90 days from the creation of the business entity to file. Starting on January 1, 2025, new businesses will only be given 30 days to file.

If there is any change to the business or the owners address or ID, the business, the same time frame applies to the amended report.

The penalty for not filing on time, or with incorrect information, is $500 a day, or up to two years in jail.

You can find more information on the BOI here: https://boiefiling.fincen.gov/help