The extension deadline for businesses is fast approaching!

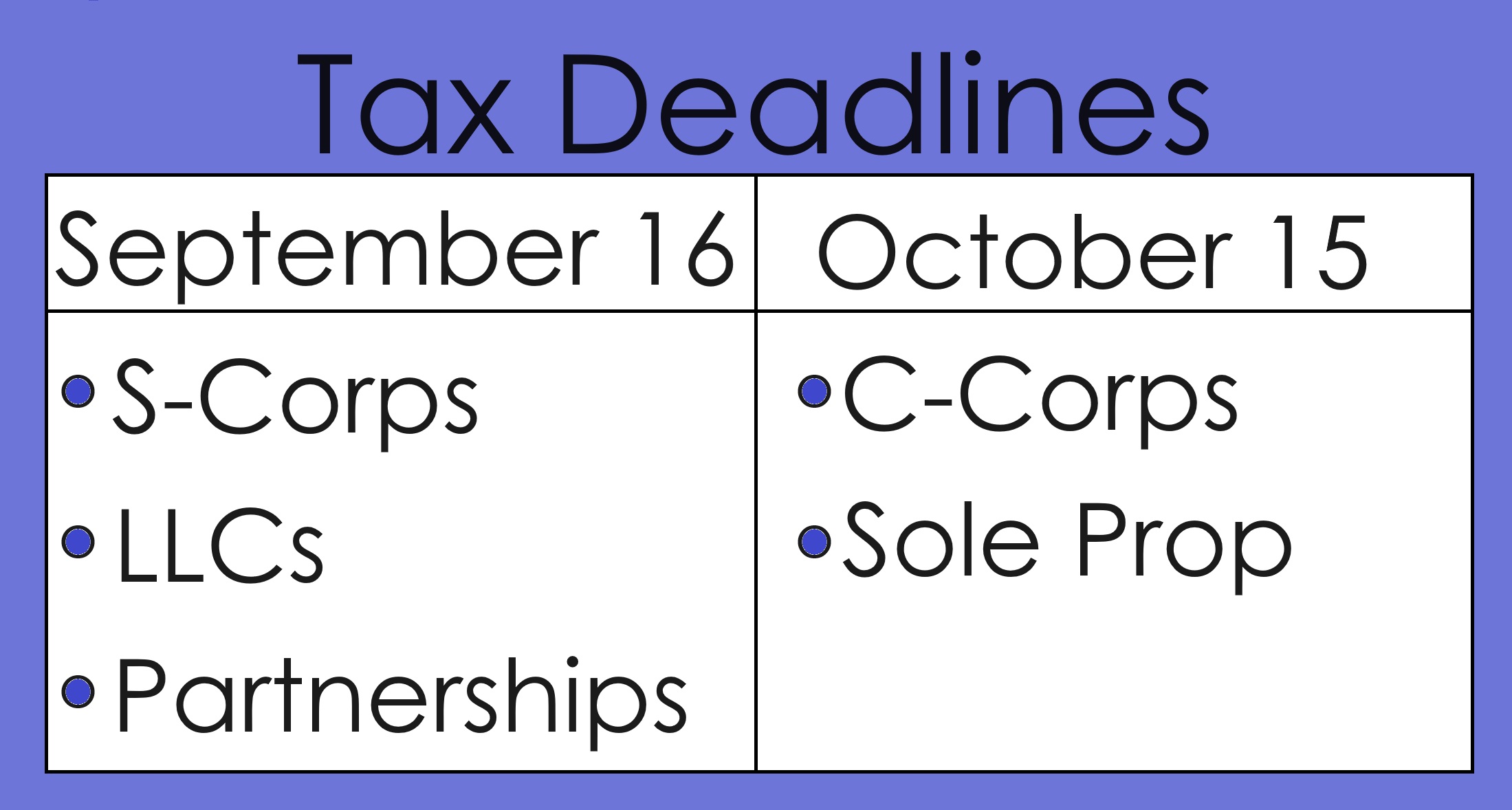

The deadline for LLCs, S-Corps, and Partnerships is September 16th, and the deadline for C-Corps and Sole Proprietorships is October 15th. The IRS penalty for filing late is $235 per month per partner/shareholder- and the IRS will backdate it to March 15th.* With the fines being so severe, it’s important to get your business filed before the deadline.

To file for a business, a profit and loss statement is required. If you don’t have one, you can visit our Templates and Links page for a simple income and expenses worksheet.

You can upload your profit and loss statement to our Atom Portal or drop it off at our office between the hours of 9:00 and 5:00 Monday through Friday. To file on time, we need to have all your documents before Monday September 9th, including payroll and subcontractor reports if you have paid workers.

To go through the return with us in person, schedule an appointment at (801) 227-0707. It is vital that we have all your documents well before the appointment. Once we have all of your documents, we will a preliminary return for your review.

Make sure to make your appointment quickly as time is of the essence.

*2023 Instructions for Form 1065, Internal Revenue Service, 2023, https://www.irs.gov/pub/irs-pdf/i1065.pdf